The Essential Overview to Selecting a Hard Cash Lender for Your Next Job

Picking a hard money loan provider is an essential step for any type of capitalist. The appropriate lender can greatly influence the success of a project. Variables such as credibility, finance terms, and responsiveness are essential in this decision. Understanding these aspects can lead to a smoother borrowing experience. Nevertheless, several neglect important information that might influence their option. What should financiers focus on to guarantee they choose the very best loan provider for their requirements?

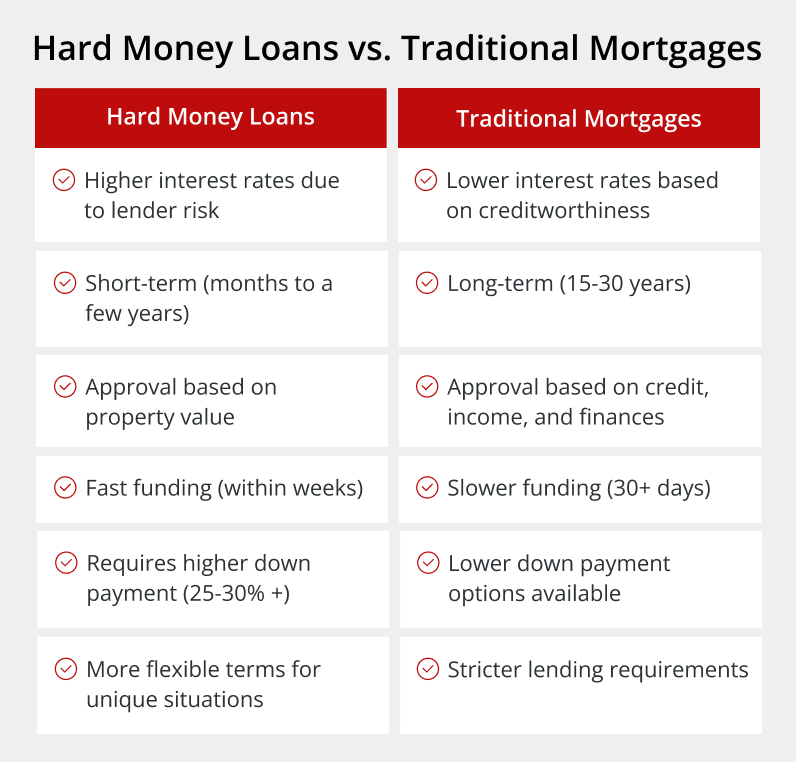

Understanding Hard Cash Borrowing

Difficult cash financing can appear daunting at first, it serves as a crucial alternative for consumers that may not certify for traditional funding. This kind of car loan is mostly secured by realty, making the residential property itself the primary element in the lending choice rather than the borrower's credit report. Hard cash lenders normally offer fast access to funds, which is particularly beneficial for financiers seeking to maximize time-sensitive possibilities. Finance terms are usually much shorter, typically ranging from six months to 3 years, with higher rate of interest reflecting the increased risk taken by loan providers. Understanding these basics can aid consumers browse the landscape of Hard cash loaning, identifying its role in realty financial investment and advancement.

Benefits of Functioning With Hard Money Lenders

Hard cash loan providers provide unique advantages for debtors seeking fast accessibility to funds. The faster funding procedure enables capitalists to seize time-sensitive chances, while adaptable loan terms cater to a selection of financial scenarios. These advantages make Hard money offering an appealing choice for those seeking instant resources.

Faster Funding Refine

Numerous financiers transform to Hard cash lenders for their expedited funding procedure when time is of the significance. Unlike typical banks, Hard money lending institutions commonly need much less documentation and can authorize Loans promptly, allowing financiers to take opportunities before they disappear. The streamlined application procedure normally entails minimal bureaucratic obstacles, enabling faster decision-making. Hard money lending institutions focus mostly on the worth of the residential property instead of the customer's credit reliability, which significantly accelerates the approval timeline. This fast access to funds is particularly advantageous in competitive actual estate markets, where hold-ups can cause missed out on opportunities. By picking Hard money lending institutions, capitalists can act promptly, ensuring they remain ahead in their financial investment undertakings.

Versatile Funding Terms

Just how do versatile finance terms improve the appeal of Hard cash lending institutions for financiers? Capitalists commonly locate that Hard cash lending institutions supply adaptable finance terms customized to their certain requirements, making them an appealing option for numerous jobs. These loan providers usually offer options regarding repayment schedules, rates of interest, and financing amounts, permitting financiers to align their funding with their money flow and project timelines. This flexibility can greatly benefit genuine estate financiers looking for fast financing for remodelling or procurement projects. In addition, such terms can accommodate various danger accounts and investment approaches, allowing capitalists to pursue possibilities that conventional lending institutions may ignore. Ultimately, adaptable lending terms equip financiers to make more informed choices and optimize their investment capacity.

Secret Factors to Consider When Picking a Lending institution

Selecting the ideal Hard cash loan provider entails several crucial elements that can significantly affect the success of a property financial investment. One have to evaluate the lending institution's loan-to-value (LTV) proportion, as this identifies the amount of funding offered loved one to the residential or commercial property's worth. In addition, recognizing the rate of interest and fees related to the lending is crucial, as these can impact overall productivity. The speed of funding is another vital consideration; a lender who can quicken the financing procedure may be read what he said vital for time-sensitive projects. Moreover, taking a look at the regards to payment, including period and versatility, can aid line up the funding with the investor's technique. Ultimately, clear communication and responsiveness from the lender can boost the borrowing experience substantially.

Assessing Loan Provider Track Record and Experience

A loan provider's online reputation and experience play considerable functions in the decision-making procedure for capitalists seeking Hard money finances. A well-regarded lending institution frequently shows reliability and professionalism, which can boost an investor's self-confidence. Testimonials and testimonials from previous customers serve as important resources for figuring out a lender's reliability. Direct Hard Money Lenders. Additionally, the length of time a lending institution has remained in the company can show their know-how and capability to navigate market fluctuations. Experienced lending institutions are commonly a lot more adept at assessing projects and giving customized services. Financiers need to seek lending institutions that have a proven performance history in funding similar projects, as this experience can cause smoother deals and better results. Inevitably, reputation and experience are important signs of a loan provider's prospective performance

Comparing Funding Terms and Rates

The Application Refine for Hard Cash Loans

Maneuvering the application procedure for Hard money Loans can be uncomplicated if consumers recognize the essential actions. Originally, possible borrowers should gather important documentation, including residential or commercial property information, economic statements, and a detailed job strategy. This information aids lenders examine the danger and potential return on investment.

Next, consumers must identify appropriate Hard cash lending institutions by researching their terms, prices, and online reputation. When a loan provider is picked, applicants submit their documents for evaluation. The lender typically performs a property evaluation to determine its worth.

After the appraisal, customers might get a financing proposition describing problems and terms. Upon agreement, funds are disbursed, enabling the customer to continue with their task. Clear interaction throughout this procedure is essential for an effective result.

Regularly Asked Inquiries

What Sorts of Projects Are Best Fit for Hard Money Loans?

Hard cash Loans are best fit for short-term jobs calling for fast funding, such as property flips, remodellings, or immediate acquisitions. Investors often like these Loans for their adaptability and speed compared to typical financing choices.

Exactly How Promptly Can I Receive Funding From a Difficult Cash Loan Provider?

The speed of financing from Hard cash lending institutions generally ranges from a few days to a week. Factors affecting this timeline consist of the loan provider's procedures, the task's intricacy, and the consumer's readiness with needed documents.

Are There Prepayment Penalties With Hard Cash Loans?

Asking about early repayment charges with Hard cash Loans exposes that many lending institutions enforce such fees. Nevertheless, terms vary substantially, making it essential for consumers to assess financing arrangements very carefully to understand prospective monetary effects.

Can I Use Hard Cash Loans for Personal Expenses?

Hard money Loans are mostly designed for actual estate financial investments. Utilizing them for individual expenditures is normally not suggested, as loan providers normally anticipate funds to be alloted towards property-related tasks, limiting their use for individual needs.

What Happens if I Default on a Hard Cash Financing?

If a specific defaults on a difficult cash car loan, the loan provider normally initiates repossession process on the property securing the lending, resulting in prospective loss of the possession and damage to the customer's credit history.

Unlike traditional banks, Hard cash loan providers usually require much less documentation and can accept Loans swiftly, enabling investors to take chances before they disappear. Exactly how do flexible loan terms enhance the appeal of Hard cash lenders for financiers? Financiers often discover that Hard money loan providers provide adaptable lending terms customized to their details requirements, making them an attractive choice for numerous projects. Direct Hard Money Lenders. look at here now A loan provider's track record and experience play significant functions in the decision-making process for investors looking for Hard money financings. When evaluating Hard cash loan providers, comparing loan terms and prices is crucial for making enlightened financial choices